Calculate Your Benefit

PERA pensions are calculated using a formula that includes your salary, service, and age. The longer you work in PERA-covered employment, the larger your retirement benefit.

How Your Benefit is Calculated

Your benefit calculation is based on three factors: your highest average salary, service credit, and age at retirement.

Highest Average Salary

Your highest average salary, also known as your high-five salary, is used to calculate your monthly benefit. It is the five consecutive years, or 60 months, during which your salary is the greatest.

- Your highest average salary can be at any point in your career.

- A break in public service does not affect your highest average salary–we ignore that gap.

- If you have less than 60 months of salary and are vested, we will use your entire salary history to determine your highest average salary.

Service Credit

You earn one service credit each month you contribute to PERA.

- Your service credit is not impacted by how many days you work in a month (even if you work one day, you can still earn service credit for that month!)

- You do not have to work a full year to get credit (you receive credit for each month that you work).

Retirement Age

You will receive your full, unreduced benefit if you are at full retirement age or older when your pension begins. If you decide to retire early, an early retirement factor is applied to your benefit calculation which reduces your monthly benefit amount because it will be paid to you for a longer time period.

Benefit Formula

Your years of service are combined with your plan multiplier to create a formula percentage. This formula is multiplied by your highest average salary to obtain your monthly benefit amount. An early retirement factor will be applied to your benefit calculation if you decide to retire early.

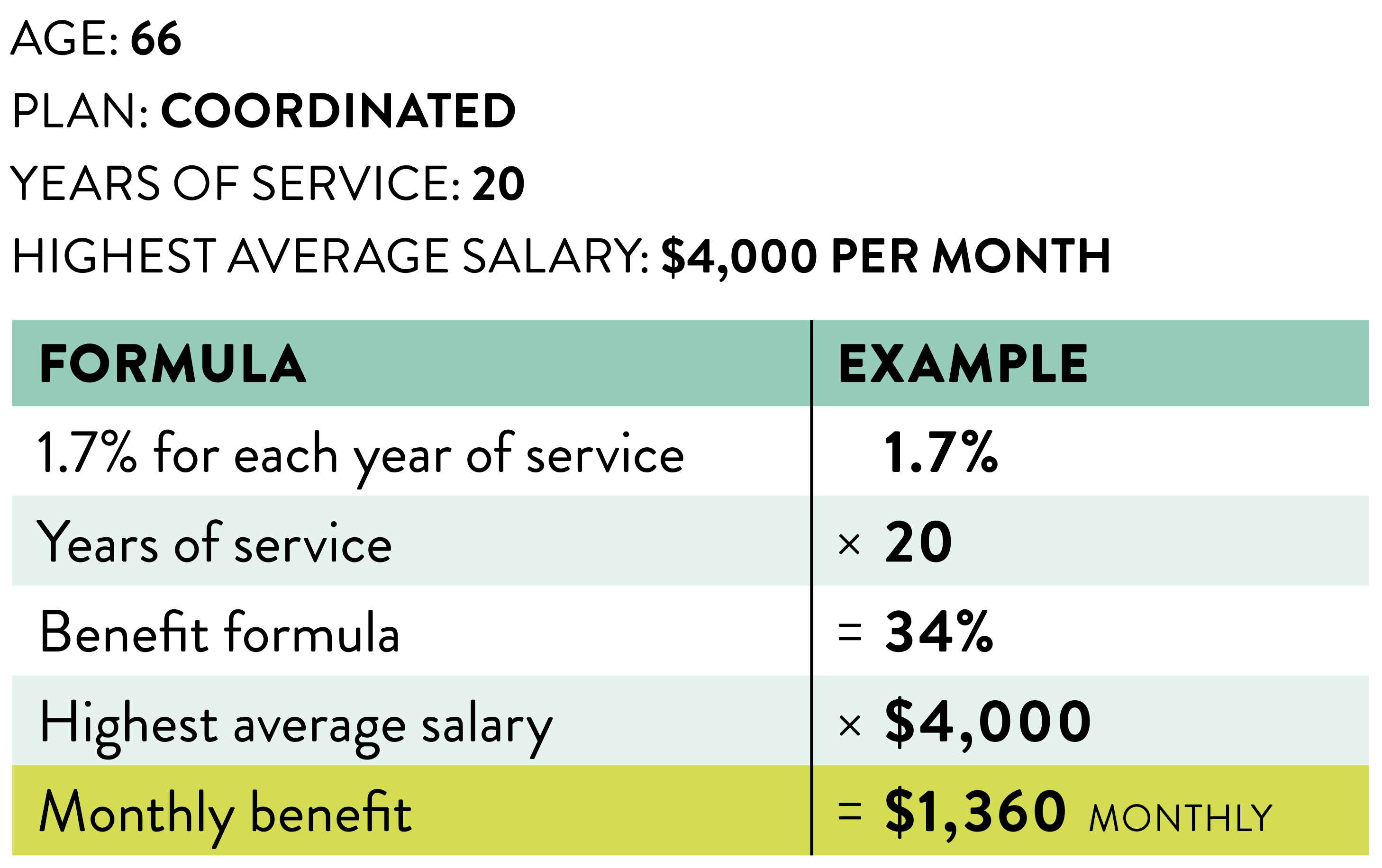

Calculation Example

This example shows a Coordinated member at full retirement age, with 20 years of service, and a highest average salary of $4,000 a month.

They receive 1.7% of their salary for each year of service, giving them a benefit formula of 34%. This is multiplied by their highest average salary of $4,000/month, giving them a monthly benefit of $1,360.

The multiplier is different for each plan.

| Multiplier | Earliest Retirement Age | Full Retirement Age | |

|---|---|---|---|

| Coordinated | 1.7% | 55 | 66 |

| Police & Fire | 3% | 50 | 55 |

| Correctional | 1.9% | 50 | 55 |