About

You serve Minnesota. We serve you.

Who We Are

Established by the Minnesota legislature in 1931, the Minnesota Public Employees Retirement Association (PERA) administers five retirement plans that serve county, city, school, and other local government public employees and their beneficiaries.

We serve nearly 500,000 current and former public employees from 2,100 governmental agencies and pay monthly benefits to more than 135,000 retirees, disabled members, and survivors of deceased members. Our 185,000 active members are social workers, firefighters, nurses, police officers, correctional officers, snowplow drivers, attorneys, and paraprofessionals. The services they provide and the work they do make our communities better.

Benefits are funded by investment earnings, the employer, and its employees. Contributions over a member’s career are made by both the member and employer, and invested and managed by the State Board of Investment. Two-thirds of our revenue comes from professional investing over a long horizon.

Our Mission

Our mission is to administer and promote sustainable retirement plans and provide services our members value.

We do this by providing secure retirement benefits members can count on at affordable rates for public employers, with member-focused service delivery.

Our History

In 1931, during the Great Depression, a group of public employees asked the state of Minnesota for legislation authorizing a retirement association for all public employees not covered by the state’s existing retirement plan (established in 1929). The Minnesota Legislature decided that a large retirement association would be able to operate more economically and efficiently than the smaller versions that already existed, so on April 24, 1931 they established the Public Employees Retirement Association of Minnesota. Operations began officially a few months later on July 1.

PERA now administers three statewide retirement plans providing a defined benefit plan (DBP) to participating public employees in the state of Minnesota. In addition, we manage a statewide retirement plan providing defined contribution (DCP) coverage to public officials, city managers, physicians, and certain ambulance service personnel, rescue squad personnel, and volunteer firefighters. We also manage a lump-sum defined benefit plan for volunteer firefighters in the state. All of these programs are tax-qualified retirement plans under Section 401(a) of the Internal Revenue Code.

Our Agency

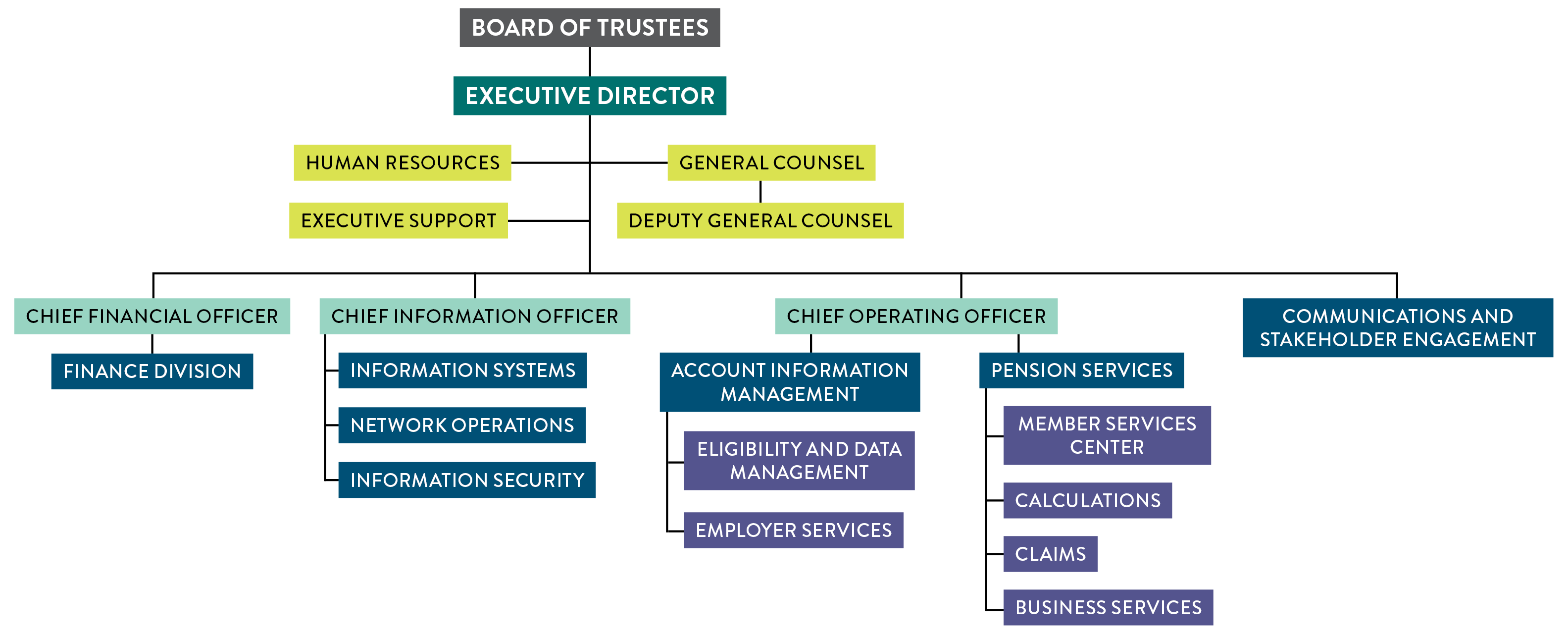

PERA's Organizational Chart

Executive Director

Doug Anderson

doug.anderson@mnpera.org

General Counsel

Joshua Harrison

joshua.harrison@mnpera.org

Chief Financial Officer

Tracy Gebhard

tracy.gebhard@mnpera.org

Chief Information Officer

Mark Sauceman

mark.sauceman@mnpera.org

Chief Operating Officer

Don Haller

don.haller@mnpera.org

Account Information Manager

Heather Schoenberger

heather.schoenberger@mnpera.org

Pension Services Manager

Tim Knippenberg

tim.knippenberg@mnpera.org